Impact of Order Latency

This example illustrates the impact of order latency on the performance of the strategy.

Note: This example is for educational purposes only and demonstrates effective strategies for high-frequency market-making schemes. All backtests are based on a 0.005% rebate, the highest market maker rebate available on Binance Futures. See Binance Upgrades USDⓢ-Margined Futures Liquidity Provider Program for more details.

[1]:

from numba import njit

import numpy as np

from numba.typed import Dict

from hftbacktest import (

HftBacktest,

NONE,

NEW,

GTX,

BUY,

SELL,

ConstantLatency,

FeedLatency,

IntpOrderLatency,

SquareProbQueueModel,

Linear,

Stat

)

@njit

def measure_trading_intensity(order_arrival_depth, out):

max_tick = 0

for depth in order_arrival_depth:

if not np.isfinite(depth):

continue

# Sets the tick index to 0 for the nearest possible best price

# as the order arrival depth in ticks is measured from the mid-price

tick = round(depth / .5) - 1

# In a fast-moving market, buy trades can occur below the mid-price (and vice versa for sell trades)

# since the mid-price is measured in a previous time-step;

# however, to simplify the problem, we will exclude those cases.

if tick < 0 or tick >= len(out):

continue

# All of our possible quotes within the order arrival depth,

# excluding those at the same price, are considered executed.

out[:tick] += 1

max_tick = max(max_tick, tick)

return out[:max_tick]

@njit

def linear_regression(x, y):

sx = np.sum(x)

sy = np.sum(y)

sx2 = np.sum(x ** 2)

sxy = np.sum(x * y)

w = len(x)

slope = (w * sxy - sx * sy) / (w * sx2 - sx**2)

intercept = (sy - slope * sx) / w

return slope, intercept

@njit

def compute_coeff(xi, gamma, delta, A, k):

inv_k = np.divide(1, k)

c1 = 1 / (xi * delta) * np.log(1 + xi * delta * inv_k)

c2 = np.sqrt(np.divide(gamma, 2 * A * delta * k) * ((1 + xi * delta * inv_k) ** (k / (xi * delta) + 1)))

return c1, c2

@njit

def gridtrading_glft_mm(hbt, stat):

arrival_depth = np.full(10_000_000, np.nan, np.float64)

mid_price_chg = np.full(10_000_000, np.nan, np.float64)

t = 0

prev_mid_price_tick = np.nan

mid_price_tick = np.nan

tmp = np.zeros(500, np.float64)

ticks = np.arange(len(tmp)) + .5

A = np.nan

k = np.nan

volatility = np.nan

gamma = 0.05

delta = 1

adj1 = 1

adj2 = 0.05

order_qty = 1

max_position = 20

grid_num = 20

# Checks every 100 milliseconds.

while hbt.elapse(100_000):

#--------------------------------------------------------

# Records market order's arrival depth from the mid-price.

if not np.isnan(mid_price_tick):

depth = -np.inf

for trade in hbt.last_trades:

side = trade[3]

trade_price_tick = trade[4] / hbt.tick_size

if side == BUY:

depth = np.nanmax([trade_price_tick - mid_price_tick, depth])

else:

depth = np.nanmax([mid_price_tick - trade_price_tick, depth])

arrival_depth[t] = depth

hbt.clear_last_trades()

prev_mid_price_tick = mid_price_tick

mid_price_tick = (hbt.best_bid_tick + hbt.best_ask_tick) / 2.0

# Records the mid-price change for volatility calculation.

mid_price_chg[t] = mid_price_tick - prev_mid_price_tick

#--------------------------------------------------------

# Calibrates A, k and calculates the market volatility.

# Updates A, k, and the volatility every 5-sec.

if t % 50 == 0:

# Window size is 10-minute.

if t >= 6_000 - 1:

# Calibrates A, k

tmp[:] = 0

lambda_ = measure_trading_intensity(arrival_depth[t + 1 - 6_000:t + 1], tmp)

lambda_ = lambda_[:70] / 600

x = ticks[:len(lambda_)]

y = np.log(lambda_)

k_, logA = linear_regression(x, y)

A = np.exp(logA)

k = -k_

# Updates the volatility.

volatility = np.nanstd(mid_price_chg[t + 1 - 6_000:t + 1]) * np.sqrt(10)

#--------------------------------------------------------

# Computes bid price and ask price.

c1, c2 = compute_coeff(gamma, gamma, delta, A, k)

half_spread = (c1 + 1 / 2 * c2 * volatility) * adj1

skew = c2 * volatility * adj2

bid_depth = half_spread + skew * hbt.position

ask_depth = half_spread - skew * hbt.position

# If the depth is invalid, set a large spread to prevent execution.

if not np.isfinite(bid_depth):

bid_depth = 1_000

if not np.isfinite(ask_depth):

ask_depth = 1_000

bid_price = min(round(mid_price_tick - bid_depth), hbt.best_bid_tick) * hbt.tick_size

ask_price = max(round(mid_price_tick + ask_depth), hbt.best_ask_tick) * hbt.tick_size

grid_interval = round(max(half_spread, 1)) * hbt.tick_size

bid_price = np.floor(bid_price / grid_interval) * grid_interval

ask_price = np.ceil(ask_price / grid_interval) * grid_interval

#--------------------------------------------------------

# Updates quotes.

hbt.clear_inactive_orders()

# Creates a new grid for buy orders.

new_bid_orders = Dict.empty(np.int64, np.float64)

if hbt.position < max_position:

for i in range(grid_num):

bid_price -= i * grid_interval

bid_price_tick = round(bid_price / hbt.tick_size)

# order price in tick is used as order id.

new_bid_orders[bid_price_tick] = bid_price

for order in hbt.orders.values():

# Cancels if an order is not in the new grid.

if order.side == BUY and order.cancellable and order.order_id not in new_bid_orders:

hbt.cancel(order.order_id)

for order_id, order_price in new_bid_orders.items():

# Posts an order if it doesn't exist.

if order_id not in hbt.orders:

hbt.submit_buy_order(order_id, order_price, order_qty, GTX)

# Creates a new grid for sell orders.

new_ask_orders = Dict.empty(np.int64, np.float64)

if hbt.position > -max_position:

for i in range(grid_num):

ask_price += i * grid_interval

ask_price_tick = round(ask_price / hbt.tick_size)

# order price in tick is used as order id.

new_ask_orders[ask_price_tick] = ask_price

for order in hbt.orders.values():

# Cancels if an order is not in the new grid.

if order.side == SELL and order.cancellable and order.order_id not in new_ask_orders:

hbt.cancel(order.order_id)

for order_id, order_price in new_ask_orders.items():

# Posts an order if it doesn't exist.

if order_id not in hbt.orders:

hbt.submit_sell_order(order_id, order_price, order_qty, GTX)

t += 1

if t >= len(arrival_depth) or t >= len(mid_price_chg):

raise Exception

# Records the current state for stat calculation.

stat.record(hbt)

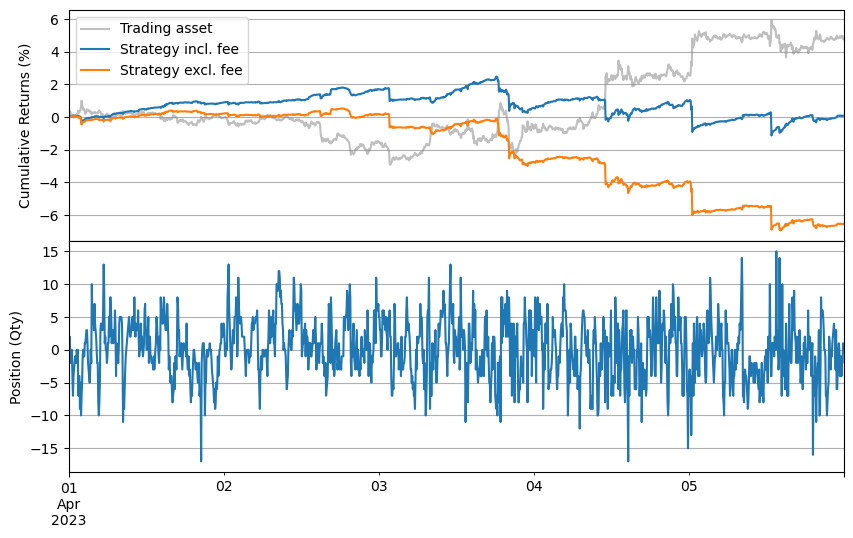

Order Latency from Feed Latency

[2]:

hbt = HftBacktest(

[

'data/ethusdt_20230401.npz',

'data/ethusdt_20230402.npz',

'data/ethusdt_20230403.npz',

'data/ethusdt_20230404.npz',

'data/ethusdt_20230405.npz',

],

tick_size=0.01,

lot_size=0.001,

maker_fee=-0.00005,

taker_fee=0.0007,

order_latency=FeedLatency(),

queue_model=SquareProbQueueModel(),

asset_type=Linear,

snapshot='data/ethusdt_20230331_eod.npz',

trade_list_size=10_000

)

stat = Stat(hbt)

gridtrading_glft_mm(hbt, stat.recorder)

stat.summary(capital=25_000)

Load data/ethusdt_20230401.npz

Load data/ethusdt_20230402.npz

Load data/ethusdt_20230403.npz

Load data/ethusdt_20230404.npz

Load data/ethusdt_20230405.npz

=========== Summary ===========

Sharpe ratio: 4.6

Sortino ratio: 3.3

Risk return ratio: 43.1

Annualised return: 119.45 %

Max. draw down: 2.77 %

The number of trades per day: 3212

Avg. daily trading volume: 3212

Avg. daily trading amount: 5886441

Max leverage: 3.40

Median leverage: 0.22

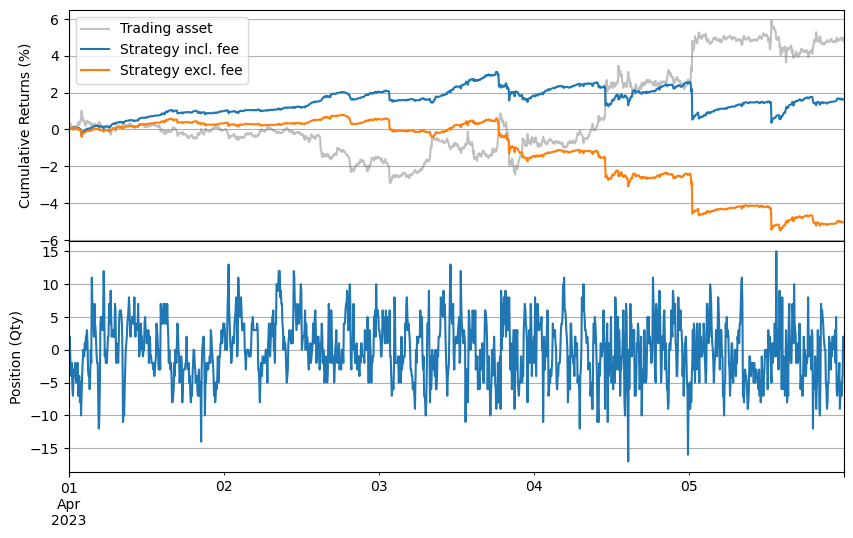

Historical Order Latency

[3]:

latency_data = np.concatenate(

[np.load('../latency/ethusdt_{}_latency.npz'.format(date))['data'] for date in range(20230401, 20230406)]

)

hbt = HftBacktest(

[

'data/ethusdt_20230401.npz',

'data/ethusdt_20230402.npz',

'data/ethusdt_20230403.npz',

'data/ethusdt_20230404.npz',

'data/ethusdt_20230405.npz',

],

tick_size=0.01,

lot_size=0.001,

maker_fee=-0.00005,

taker_fee=0.0007,

order_latency=IntpOrderLatency(data=latency_data),

queue_model=SquareProbQueueModel(),

asset_type=Linear,

snapshot='data/ethusdt_20230331_eod.npz',

trade_list_size=10_000

)

stat = Stat(hbt)

gridtrading_glft_mm(hbt, stat.recorder)

stat.summary(capital=25_000)

Load data/ethusdt_20230401.npz

Load data/ethusdt_20230402.npz

Load data/ethusdt_20230403.npz

Load data/ethusdt_20230404.npz

Load data/ethusdt_20230405.npz

=========== Summary ===========

Sharpe ratio: 0.4

Sortino ratio: 0.3

Risk return ratio: 2.8

Annualised return: 11.03 %

Max. draw down: 4.00 %

The number of trades per day: 3493

Avg. daily trading volume: 3493

Avg. daily trading amount: 6401297

Max leverage: 2.47

Median leverage: 0.22

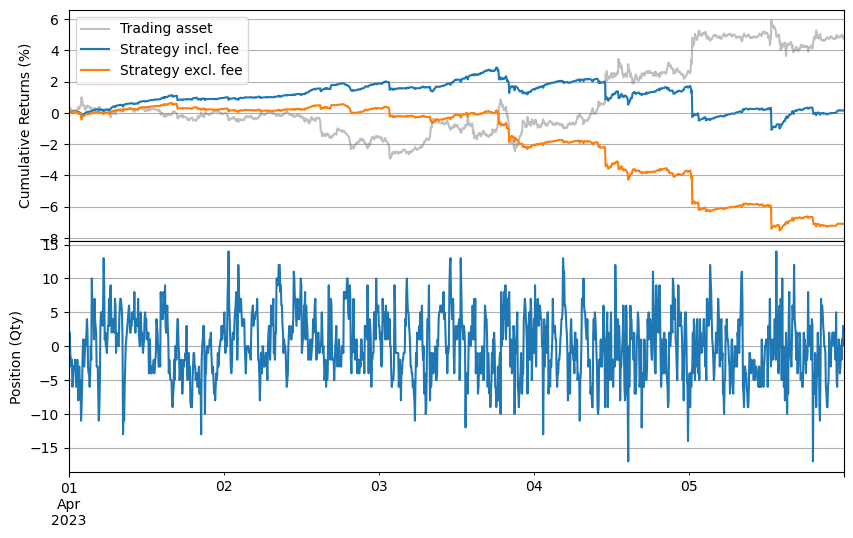

Order Latency from Amplified Feed Latency

[4]:

hbt = HftBacktest(

[

'data/ethusdt_20230401.npz',

'data/ethusdt_20230402.npz',

'data/ethusdt_20230403.npz',

'data/ethusdt_20230404.npz',

'data/ethusdt_20230405.npz',

],

tick_size=0.01,

lot_size=0.001,

maker_fee=-0.00005,

taker_fee=0.0007,

order_latency=FeedLatency(entry_latency_mul=4, resp_latency_mul=3),

queue_model=SquareProbQueueModel(),

asset_type=Linear,

snapshot='data/ethusdt_20230331_eod.npz',

trade_list_size=10_000

)

stat = Stat(hbt)

gridtrading_glft_mm(hbt, stat.recorder)

stat.summary(capital=25_000)

Load data/ethusdt_20230401.npz

Load data/ethusdt_20230402.npz

Load data/ethusdt_20230403.npz

Load data/ethusdt_20230404.npz

Load data/ethusdt_20230405.npz

=========== Summary ===========

Sharpe ratio: 0.2

Sortino ratio: 0.2

Risk return ratio: 1.8

Annualised return: 6.66 %

Max. draw down: 3.61 %

The number of trades per day: 3193

Avg. daily trading volume: 3193

Avg. daily trading amount: 5849525

Max leverage: 4.57

Median leverage: 0.22