High-Frequency Grid Trading

Note: This example is for educational purposes only and demonstrates effective strategies for high-frequency market-making schemes. All backtests are based on a 0.005% rebate, the highest market maker rebate available on Binance Futures. See Binance Upgrades USDⓢ-Margined Futures Liquidity Provider Program for more details.

Plain High-Frequency Grid Trading

This is a high-frequency version of Grid Trading that keeps posting orders on grids centered around the mid-price, maintaining a fixed interval and a set number of grids.

[3]:

from numba import njit

import pandas as pd

import numpy as np

from numba.typed import Dict

from hftbacktest import NONE, NEW, HftBacktest, GTX, FeedLatency, SquareProbQueueModel, BUY, SELL, Linear, Stat, reset

@njit

def gridtrading(hbt, stat):

max_position = 5

grid_interval = hbt.tick_size * 10

grid_num = 20

half_spread = hbt.tick_size * 20

# Running interval in microseconds

while hbt.elapse(100_000):

# Clears cancelled, filled or expired orders.

hbt.clear_inactive_orders()

mid_price = (hbt.best_bid + hbt.best_ask) / 2.0

bid_order_begin = np.floor((mid_price - half_spread) / grid_interval) * grid_interval

ask_order_begin = np.ceil((mid_price + half_spread) / grid_interval) * grid_interval

order_qty = 0.1

last_order_id = -1

# Creates a new grid for buy orders.

new_bid_orders = Dict.empty(np.int64, np.float64)

if hbt.position < max_position:

for i in range(grid_num):

bid_order_begin -= i * grid_interval

bid_order_tick = round(bid_order_begin / hbt.tick_size)

# Do not post buy orders above the best bid.

if bid_order_tick > hbt.best_bid_tick:

continue

# order price in tick is used as order id.

new_bid_orders[bid_order_tick] = bid_order_begin

for order in hbt.orders.values():

# Cancels if an order is not in the new grid.

if order.side == BUY and order.cancellable and order.order_id not in new_bid_orders:

hbt.cancel(order.order_id)

last_order_id = order.order_id

for order_id, order_price in new_bid_orders.items():

# Posts an order if it doesn't exist.

if order_id not in hbt.orders:

hbt.submit_buy_order(order_id, order_price, order_qty, GTX)

last_order_id = order_id

# Creates a new grid for sell orders.

new_ask_orders = Dict.empty(np.int64, np.float64)

if hbt.position > -max_position:

for i in range(grid_num):

ask_order_begin += i * grid_interval

ask_order_tick = round(ask_order_begin / hbt.tick_size)

# Do not post sell orders below the best ask.

if ask_order_tick < hbt.best_ask_tick:

continue

# order price in tick is used as order id.

new_ask_orders[ask_order_tick] = ask_order_begin

for order in hbt.orders.values():

# Cancels if an order is not in the new grid.

if order.side == SELL and order.cancellable and order.order_id not in new_ask_orders:

hbt.cancel(order.order_id)

last_order_id = order.order_id

for order_id, order_price in new_ask_orders.items():

# Posts an order if it doesn't exist.

if order_id not in hbt.orders:

hbt.submit_sell_order(order_id, order_price, order_qty, GTX)

last_order_id = order_id

# All order requests are considered to be requested at the same time.

# Waits until one of the order responses is received.

if last_order_id >= 0:

if not hbt.wait_order_response(last_order_id):

return False

# Records the current state for stat calculation.

stat.record(hbt)

return True

[2]:

hbt = HftBacktest(

[

'data/ethusdt_20221003.npz',

'data/ethusdt_20221004.npz',

'data/ethusdt_20221005.npz',

'data/ethusdt_20221006.npz',

'data/ethusdt_20221007.npz'

],

tick_size=0.01,

lot_size=0.001,

maker_fee=-0.00005,

taker_fee=0.0007,

order_latency=FeedLatency(),

queue_model=SquareProbQueueModel(),

asset_type=Linear,

snapshot='data/ethusdt_20221002_eod.npz'

)

stat = Stat(hbt)

Load data/ethusdt_20221003.npz

[3]:

%%time

gridtrading(hbt, stat.recorder)

Load data/ethusdt_20221004.npz

Load data/ethusdt_20221005.npz

Load data/ethusdt_20221006.npz

Load data/ethusdt_20221007.npz

CPU times: user 3min 58s, sys: 6.03 s, total: 4min 4s

Wall time: 4min 5s

[3]:

True

[4]:

stat.summary(capital=15_000)

=========== Summary ===========

Sharpe ratio: 20.9

Sortino ratio: 22.4

Risk return ratio: 211.5

Annualised return: 330.53 %

Max. draw down: 1.56 %

The number of trades per day: 5954

Avg. daily trading volume: 595

Avg. daily trading amount: 798115

Max leverage: 0.52

Median leverage: 0.21

High-Frequency Grid Trading with Skewing

By incorporating position-based skewing, the strategy’s risk-adjusted returns can be improved.

[5]:

@njit

def gridtrading(hbt, stat, skew):

max_position = 5

grid_interval = hbt.tick_size * 10

grid_num = 20

half_spread = hbt.tick_size * 20

# Running interval in microseconds

while hbt.elapse(100_000):

# Clears cancelled, filled or expired orders.

hbt.clear_inactive_orders()

mid_price = (hbt.best_bid + hbt.best_ask) / 2.0

reservation_price = mid_price - skew * hbt.position * hbt.tick_size

bid_order_begin = np.floor((reservation_price - half_spread) / grid_interval) * grid_interval

ask_order_begin = np.ceil((reservation_price + half_spread) / grid_interval) * grid_interval

order_qty = 0.1 # np.round(notional_order_qty / mid_price / hbt.lot_size) * hbt.lot_size

last_order_id = -1

# Creates a new grid for buy orders.

new_bid_orders = Dict.empty(np.int64, np.float64)

if hbt.position < max_position: # hbt.position * mid_price < max_notional_position

for i in range(grid_num):

bid_order_begin -= i * grid_interval

bid_order_tick = round(bid_order_begin / hbt.tick_size)

# Do not post buy orders above the best bid.

if bid_order_tick > hbt.best_bid_tick:

continue

# order price in tick is used as order id.

new_bid_orders[bid_order_tick] = bid_order_begin

for order in hbt.orders.values():

# Cancels if an order is not in the new grid.

if order.side == BUY and order.cancellable and order.order_id not in new_bid_orders:

hbt.cancel(order.order_id)

last_order_id = order.order_id

for order_id, order_price in new_bid_orders.items():

# Posts an order if it doesn't exist.

if order_id not in hbt.orders:

hbt.submit_buy_order(order_id, order_price, order_qty, GTX)

last_order_id = order_id

# Creates a new grid for sell orders.

new_ask_orders = Dict.empty(np.int64, np.float64)

if hbt.position > -max_position: # hbt.position * mid_price > -max_notional_position

for i in range(grid_num):

ask_order_begin += i * grid_interval

ask_order_tick = round(ask_order_begin / hbt.tick_size)

# Do not post sell orders below the best ask.

if ask_order_tick < hbt.best_ask_tick:

continue

# order price in tick is used as order id.

new_ask_orders[ask_order_tick] = ask_order_begin

for order in hbt.orders.values():

# Cancels if an order is not in the new grid.

if order.side == SELL and order.cancellable and order.order_id not in new_ask_orders:

hbt.cancel(order.order_id)

last_order_id = order.order_id

for order_id, order_price in new_ask_orders.items():

# Posts an order if it doesn't exist.

if order_id not in hbt.orders:

hbt.submit_sell_order(order_id, order_price, order_qty, GTX)

last_order_id = order_id

# All order requests are considered to be requested at the same time.

# Waits until one of the order responses is received.

if last_order_id >= 0:

if not hbt.wait_order_response(last_order_id):

return False

# Records the current state for stat calculation.

stat.record(hbt)

return True

Weak skew

[6]:

reset(

hbt,

[

'data/ethusdt_20221003.npz',

'data/ethusdt_20221004.npz',

'data/ethusdt_20221005.npz',

'data/ethusdt_20221006.npz',

'data/ethusdt_20221007.npz'

],

snapshot='data/ethusdt_20221002_eod.npz'

)

stat = Stat(hbt)

skew = 1

gridtrading(hbt, stat.recorder, skew)

stat.summary(capital=15_000)

Load data/ethusdt_20221003.npz

Load data/ethusdt_20221004.npz

Load data/ethusdt_20221005.npz

Load data/ethusdt_20221006.npz

Load data/ethusdt_20221007.npz

=========== Summary ===========

Sharpe ratio: 18.0

Sortino ratio: 17.5

Risk return ratio: 169.2

Annualised return: 166.77 %

Max. draw down: 0.99 %

The number of trades per day: 6488

Avg. daily trading volume: 648

Avg. daily trading amount: 870207

Max leverage: 0.50

Median leverage: 0.10

Strong skew

[7]:

reset(

hbt,

[

'data/ethusdt_20221003.npz',

'data/ethusdt_20221004.npz',

'data/ethusdt_20221005.npz',

'data/ethusdt_20221006.npz',

'data/ethusdt_20221007.npz'

],

snapshot='data/ethusdt_20221002_eod.npz'

)

stat = Stat(hbt)

skew = 10

gridtrading(hbt, stat.recorder, skew)

stat.summary(capital=15_000)

Load data/ethusdt_20221003.npz

Load data/ethusdt_20221004.npz

Load data/ethusdt_20221005.npz

Load data/ethusdt_20221006.npz

Load data/ethusdt_20221007.npz

=========== Summary ===========

Sharpe ratio: 29.3

Sortino ratio: 33.4

Risk return ratio: 735.4

Annualised return: 100.30 %

Max. draw down: 0.14 %

The number of trades per day: 6636

Avg. daily trading volume: 663

Avg. daily trading amount: 889749

Max leverage: 0.51

Median leverage: 0.02

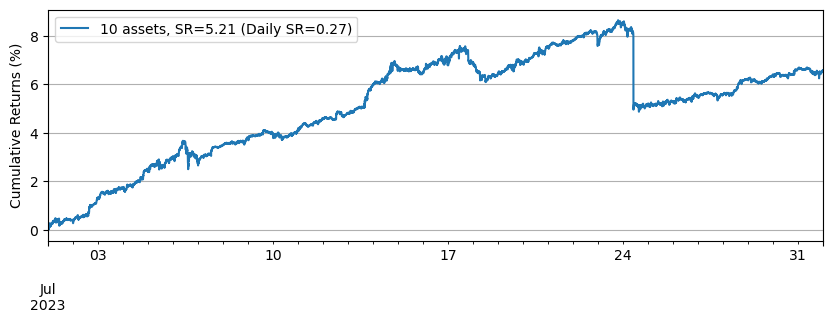

Multiple Assets

You might need to find the proper parameters for each asset to achieve better performance. As an example, here it uses single parameters set to demonstrate how the performance of a combination of multiple assets will be.

[8]:

@njit

def gridtrading(hbt, stat, half_spread, grid_interval, skew, order_qty):

grid_num = 20

max_position = grid_num * order_qty

# Running interval in microseconds

while hbt.elapse(100_000):

mid_price = (hbt.best_bid + hbt.best_ask) / 2.0

normalized_position = hbt.position / order_qty

bid_depth = half_spread + skew * normalized_position

ask_depth = half_spread - skew * normalized_position

bid_price = min(mid_price - bid_depth, hbt.best_bid)

ask_price = max(mid_price + ask_depth, hbt.best_ask)

grid_interval = max(np.round(half_spread / hbt.tick_size) * hbt.tick_size, hbt.tick_size)

bid_price = np.floor(bid_price / grid_interval) * grid_interval

ask_price = np.ceil(ask_price / grid_interval) * grid_interval

#--------------------------------------------------------

# Updates quotes.

hbt.clear_inactive_orders()

# Creates a new grid for buy orders.

new_bid_orders = Dict.empty(np.int64, np.float64)

if hbt.position < max_position and np.isfinite(bid_price):

for i in range(grid_num):

bid_price -= i * grid_interval

bid_price_tick = round(bid_price / hbt.tick_size)

# order price in tick is used as order id.

new_bid_orders[bid_price_tick] = bid_price

for order in hbt.orders.values():

# Cancels if an order is not in the new grid.

if order.side == BUY and order.cancellable and order.order_id not in new_bid_orders:

hbt.cancel(order.order_id)

for order_id, order_price in new_bid_orders.items():

# Posts an order if it doesn't exist.

if order_id not in hbt.orders:

hbt.submit_buy_order(order_id, order_price, order_qty, GTX)

# Creates a new grid for sell orders.

new_ask_orders = Dict.empty(np.int64, np.float64)

if hbt.position > -max_position and np.isfinite(ask_price):

for i in range(grid_num):

ask_price += i * grid_interval

ask_price_tick = round(ask_price / hbt.tick_size)

# order price in tick is used as order id.

new_ask_orders[ask_price_tick] = ask_price

for order in hbt.orders.values():

# Cancels if an order is not in the new grid.

if order.side == SELL and order.cancellable and order.order_id not in new_ask_orders:

hbt.cancel(order.order_id)

for order_id, order_price in new_ask_orders.items():

# Posts an order if it doesn't exist.

if order_id not in hbt.orders:

hbt.submit_sell_order(order_id, order_price, order_qty, GTX)

# Records the current state for stat calculation.

stat.record(hbt)

return True

[9]:

from hftbacktest import IntpOrderLatency, LogProbQueueModel2, COL_PRICE, COL_SIDE

latency_data = np.concatenate(

[np.load('../latency/order_latency_{}.npz'.format(date))['data'] for date in range(20230701, 20230732)]

)

def backtest(args):

asset_name, asset_info = args

hbt = HftBacktest(

['data/{}_{}.npz'.format(asset_name, date) for date in range(20230701, 20230732)],

tick_size=asset_info['tick_size'],

lot_size=asset_info['lot_size'],

maker_fee=-0.00005,

taker_fee=0.0007,

order_latency=IntpOrderLatency(data=latency_data),

queue_model=LogProbQueueModel2(),

asset_type=Linear,

snapshot='data/{}_20230630_eod.npz'.format(asset_name)

)

stat = Stat(hbt)

# Obtains the mid-price of the assset to determine the order quantity.

data = np.load('data/{}_20230630_eod.npz'.format(asset_name))['data']

best_bid = max(data[data[:, COL_SIDE] == 1][:, COL_PRICE])

best_ask = min(data[data[:, COL_SIDE] == -1][:, COL_PRICE])

mid = (best_bid + best_ask) / 2.0

# Sets the order quantity to be equivalent to a notional value of $100.

order_qty = max(round((100 / mid) / asset_info['lot_size']), 1) * asset_info['lot_size']

half_spread = mid * 0.0008

grid_interval = mid * 0.0008

skew = mid * 0.000025

gridtrading(hbt, stat.recorder, half_spread, grid_interval, skew, order_qty)

np.savez(

'stats/{}_stat_grid_multi'.format(asset_name),

timestamp=np.asarray(stat.timestamp),

mid=np.asarray(stat.mid),

balance=np.asarray(stat.balance),

position=np.asarray(stat.position),

fee=np.asarray(stat.fee),

)

[10]:

%%capture

import json

from multiprocessing import Pool

with open('assets.json', 'r') as f:

assets = json.load(f)

with Pool(16) as p:

print(p.map(backtest, list(assets.items())))

[11]:

from matplotlib import pyplot as plt

equity_values = {}

for asset_name in assets.keys():

stat = np.load('stats/{}_stat_grid.npz'.format(asset_name))

timestamp = stat['timestamp']

mid = stat['mid']

balance = stat['balance']

position = stat['position']

fee = stat['fee']

equity = mid * position + balance - fee

equity = pd.Series(equity, index=pd.to_datetime(timestamp, unit='us', utc=True))

equity_values[asset_name] = equity.resample('5min').last()

fig = plt.figure()

fig.set_size_inches(10, 3)

legend = []

net_equity = None

for i, equity in enumerate(list(equity_values.values())):

asset_number = i + 1

if net_equity is None:

net_equity = equity.copy()

else:

net_equity += equity.copy()

if asset_number % 10 == 0:

# 2_000 is capital for each trading asset.

net_equity_ = (net_equity / asset_number) / 2_000

net_equity_rs = net_equity_.resample('1d').last()

pnl = net_equity_rs.diff()

sr = pnl.mean() / pnl.std()

ann_sr = sr * np.sqrt(365)

legend.append('{} assets, SR={:.2f} (Daily SR={:.2f})'.format(asset_number, ann_sr, sr))

(net_equity_ * 100).plot()

plt.legend(legend)

plt.grid()

plt.ylabel('Cumulative Returns (%)')

[11]:

Text(0, 0.5, 'Cumulative Returns (%)')